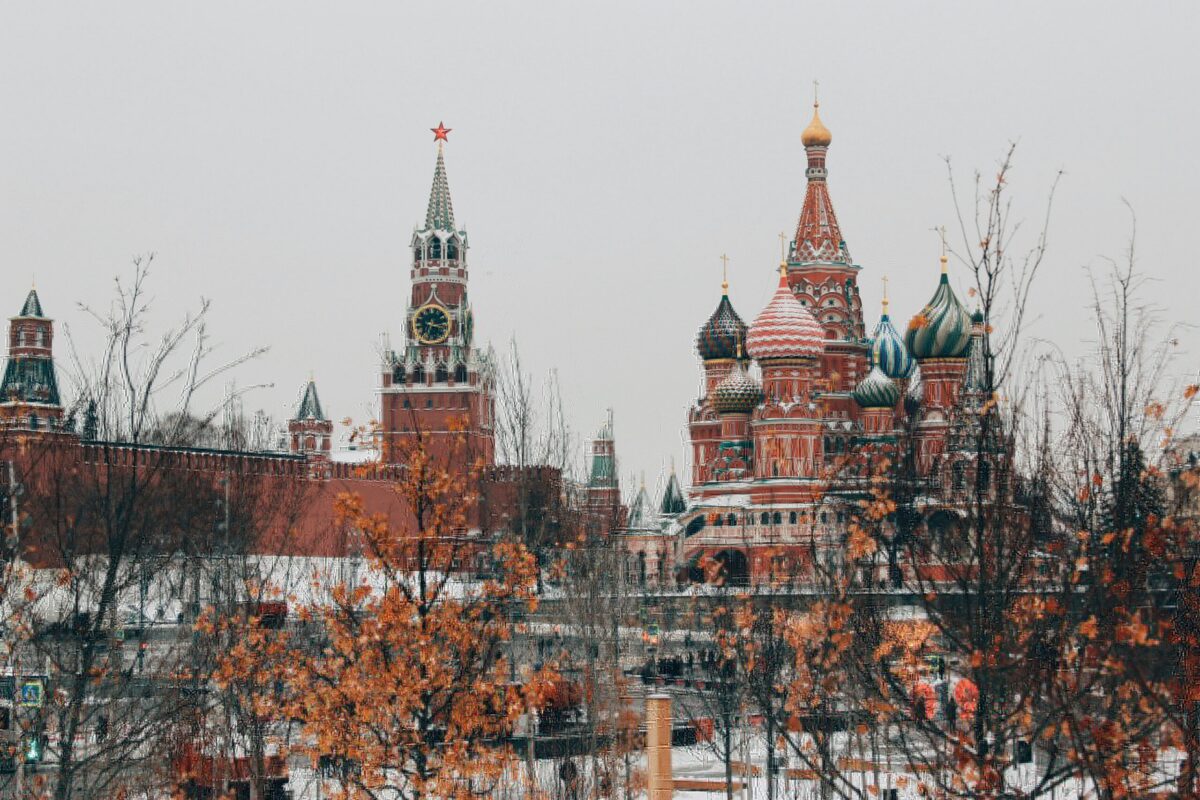

Member of Russia’s State Duma, Anton Tkachev, has suggested that the country should create a Bitcoin reserve to support its financial stability.

Tkachev, who represents the New People party, sent a formal proposal to Finance Minister Anton Siluanov.

According to Russian news agency RIA Novosti, the proposal urges the minister to assess whether setting up such a reserve is possible. Tkachev’s letter reportedly stated:

“I ask you, dear Anton Germanovich, to assess the feasibility of creating a strategic reserve of Bitcoin in Russia by analogy with state reserves in traditional currencies”. If the idea is practical, he asked for it to be presented to the government for further action.

The proposal highlights how cryptocurrencies, particularly Bitcoin, are becoming vital for international trade, especially for countries like Russia that face restrictions on accessing global payment systems due to sanctions.

Tkachev pointed out that the Central Bank of Russia is already preparing an experiment with cryptocurrency for cross-border transactions, showing that interest in digital currencies is growing within the country.

Why Bitcoin?

Tkachev’s document explains why Bitcoin could be a smart choice for a national reserve. Traditional reserves, such as the US dollar, euro, and Chinese yuan, face risks like inflation and sanctions, making them less reliable during global conflicts or economic tension.

Bitcoin, on the other hand, is decentralised, meaning no single country controls it. Tkachev argued that it offers an alternative that could protect Russia from these risks.

He also noted Bitcoin’s strong recent performance, including reaching a record value of $100,000 in December 2024. This, he said, shows that Bitcoin is not just a tool for financial security but also a profitable investment opportunity.

The proposal also mentions that setting up a Bitcoin reserve would require significant changes in government policies and better coordination between various agencies.

Tkachev said these adjustments could pave the way for other countries under sanctions to consider similar approaches.

A global trend towards Bitcoin reserves

Russia’s potential move toward a Bitcoin reserve reflects a larger trend seen around the world. Some countries are already ahead in this area.

El Salvador, for instance, introduced its Bitcoin reserve in 2021 and now holds over $554 million worth of Bitcoin. The country’s Bitcoin holdings have reportedly generated unrealised profits of around 120%.

The United States is also exploring the idea. In 2024, Senator Cynthia Lummis introduced the “Bitcoin Act”, which proposes creating a national Bitcoin reserve.

In Pennsylvania, lawmakers suggested investing 10% of the state’s funds in Bitcoin as a hedge against inflation and as a growth strategy.

President-elect Donald Trump has also shown support for using Bitcoin as a reserve asset to strengthen the US economy.

Russia’s interest in Bitcoin comes as it looks for ways to reduce its reliance on traditional financial systems, which have become less accessible due to sanctions.

This year, Russian President Vladimir Putin openly stated that Bitcoin cannot be banned and will continue to grow.

Earlier, he signed a law legalising cryptocurrency mining, signalling a shift in the country’s attitude toward digital assets.

Russia’s changing view on crypto

In recent years, Russia has made significant changes to its cryptocurrency regulations, suggesting that the government is becoming more open to digital currencies.

For instance, while profits from cryptocurrency are still taxed at 15%, the sector has been exempted from value-added tax (VAT).

Additionally, the government has allowed cryptocurrency mining with some minor restrictions.

These moves show that Russia is taking steps to integrate cryptocurrencies into its economy.

By creating a Bitcoin reserve, the country could strengthen its financial independence and reduce the risks associated with traditional currencies.

Although it is unclear whether Tkachev’s proposal will move forward, it aligns with Russia’s broader efforts to modernise its financial systems and explore alternatives in the face of global challenges.

If approved, a national Bitcoin reserve could mark a significant shift in how Russia and other nations approach financial stability in the digital age.