What is Bitcoin Halving?

Bitcoin halving is a highly significant event in the lifecycle of Bitcoin. Scheduled to occur every 210,000 blocks, this event reduces the reward for mining a new block by 50%. In other words, the reward for mining Bitcoin is halved, hence the term “Bitcoin halving”.

The Mechanism of Bitcoin Halving

Bitcoin halving is embedded in the Bitcoin protocol itself. It was established by Bitcoin’s mysterious creator, Satoshi Nakamoto, to control inflation within the digital currency system. Let’s delve into this mechanism in more detail.

The Role of Miners

Miners play a vital role in the Bitcoin network. They use powerful computers to solve complex mathematical problems, a process which verifies transactions and adds them to the blockchain. In return for this service, miners are rewarded with a certain number of Bitcoins. This is where halving comes into play.

The Impact of Halving on Miners

When a Bitcoin halving event occurs, the reward for mining a new block is halved. For instance, when Bitcoin was first launched, the reward for mining a block was 50 BTC. After the first halving in 2012, this was reduced to 25 BTC. The second halving in 2016 saw the reward drop to 12.5 BTC, and the most recent halving in May 2020 reduced the block reward to 6.25 BTC.

This mechanism ensures that the total supply of Bitcoin will never exceed 21 million. It is a unique form of ‘digital scarcity’ that sets Bitcoin apart from traditional fiat currencies.

Why Does Bitcoin Halving Matter?

Bitcoin halving is crucial because it affects the number of new Bitcoins generated and, consequently, the supply and demand dynamics of the currency. This event has historically been associated with significant price fluctuations, making it a highly anticipated event in the cryptocurrency market.

Economic Implications of Bitcoin Halving

Bitcoin halving has a notable impact on the cryptocurrency’s economics. By reducing the reward for mining, halving effectively slows the rate at which new Bitcoins are created, which can lead to an increase in price if demand remains strong.

Anticipation in the Market

Given the historical correlation between halving and price increases, there is usually a lot of speculation in the market leading up to a halving event. This speculation can itself drive up the price of Bitcoin, creating a kind of self-fulfilling prophecy.

Long-Term Price Impact

While the short-term effects of halving are often marked by increased volatility, the long-term impact is typically positive. By reducing the supply of new Bitcoins, halving has the potential to drive up the price over the long term, provided that demand for the cryptocurrency remains strong.

The Historical Impact of Bitcoin Halving

Bitcoin halving events have historically had a profound impact on the price of Bitcoin. Both the 2012 and 2016 halvings were followed by substantial bull runs. While it’s impossible to predict with certainty how future halvings will impact the price, these historical precedents provide some insight into what might happen.

The Future of Bitcoin Halving

The most recent Bitcoin halving took place in May 2020, reducing the block reward to 6.25 BTC. If the pattern continues, the next halving in 2024 will reduce the reward to 3.125 BTC. As Bitcoin gets closer to its maximum supply of 1 million, these halving events will become increasingly significant. The future of Bitcoin halving, therefore, continues to be a subject of intense interest and speculation among investors, economists, and technologists alike.

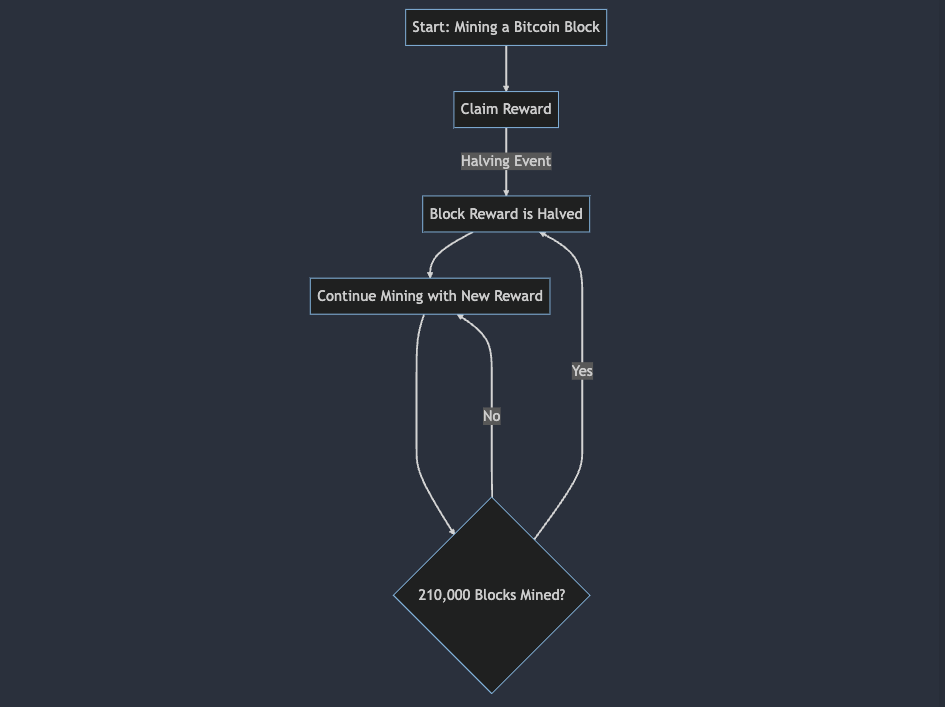

Understanding Bitcoin Halving: A Mermaid Diagram

To better visualize the Bitcoin halving process, let’s consider a simple mermaid flowchart. While markdown doesn’t support complex diagrams, this flowchart should provide a straightforward illustration of the halving process.

21 million, these halving events will become increasingly significant. The future of Bitcoin halving, therefore, continues to be a subject of intense interest and speculation among investors, economists, and technologists alike.

Understanding Bitcoin Halving: A Mermaid Diagram

To better visualize the Bitcoin halving process, let’s consider a simple mermaid flowchart. While markdown doesn’t support complex diagrams, this flowchart should provide a straightforward illustration of the halving process.

In this flowchart, we start with the mining of a Bitcoin block (A), which leads to a reward (B). When a halving event occurs (signified by the mining of 210,000 blocks), the block reward is halved (C). Miners then continue mining with the new reward (D). This cycle repeats every time 210,000 blocks are mined.

Conclusion: Bitcoin Halving and the Promise of Digital Scarcity

Bitcoin halving is a foundational aspect of Bitcoin’s economic model, designed to create digital scarcity and control inflation. It’s a testament to Bitcoin’s revolutionary design that a purely digital asset can exhibit such a property.

Bitcoin halving underscores the potential of Bitcoin as a deflationary asset and a form of ‘digital gold’. As we approach future halving events, understanding this mechanism and its implications will be essential for anyone involved in the world of cryptocurrency.

The future of Bitcoin halving is as unpredictable as it is exciting. What is certain, however, is that it will continue to draw the attention of investors, economists, and technologists around the world.