Curve Finance is a major player in the world of decentralised finance (DeFi), specialising in trading stablecoins on the Ethereum blockchain. What makes Curve different is its use of an automated market maker (AMM) system. This system cuts down on trading costs and minimises price differences during trades by using pools of money from its users.

Instead of matching buyers and sellers through a traditional trading list, Curve pools various cryptocurrencies. This setup lets people who put their digital currencies into these pools make money from transaction fees. It’s a fresh and efficient way to trade stablecoins—digital currencies designed to have a stable value, like the US dollar-based Maker and USDT, or those tied to the value of Bitcoin, such as wBTC and renBTC.

Who created Curve?

The origins of Curve remain somewhat mysterious, as its website does not disclose the team or founders. However, the white paper, published in November 2019, credits Michael Egorov as its author and he serves as the CEO. Egorov’s background is impressive, with co-founding roles in NuCypher and LoanCoins, and a PhD in Physics from Swinburne University of Technology, highlighting his expertise in quantum computing and cryptography. The Curve team is rounded out by developers Angel Angelov and Ben Hauser, along with three community managers, indicating a small but dedicated group behind the project.

How does Curve work?

Curve Finance utilises innovative mechanisms to redefine stablecoin trading in the DeFi space. Through automated market making (AMM) and liquidity pools, it offers a decentralised alternative to traditional exchanges. The platform employs a bonding curve to ensure tight exchange rates and minimal slippage. Additionally, Curve encourages participation by offering passive income opportunities through lending pools and governance via the CRV token.

Automated Market Making and Liquidity Pools

At the heart of Curve’s operation is the concept of automated market making (AMM). Unlike traditional exchanges that use order books to match buyers and sellers, AMMs rely on liquidity pools. These pools are essentially collections of funds deposited by users who, in return, earn trading fees based on the volume of transactions that utilise their liquidity. Curve’s AMM is specifically tailored for stablecoins, aiming to provide efficient and low-cost exchanges.

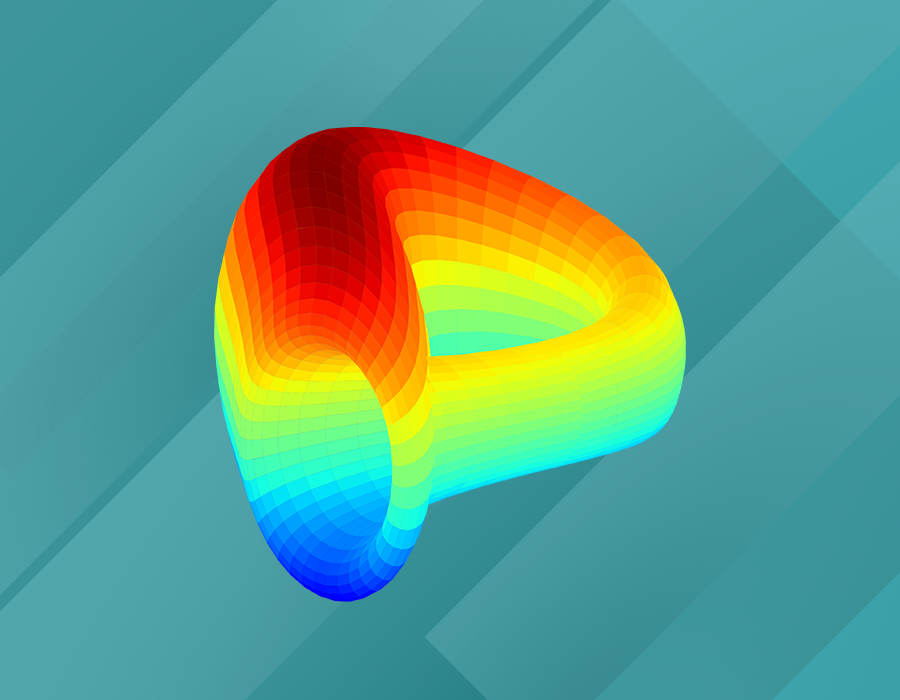

Bonding Curve Mechanism

The bonding curve is a mathematical formula that Curve uses to determine the price of stablecoins within its liquidity pools. This curve is designed to keep the exchange rates between different stablecoins extremely tight, even during large trades. The idea is to minimise price slippage, which is the difference between the expected price of a trade and the executed price. By focusing exclusively on stablecoins, which are designed to have stable values, Curve’s bonding curve can facilitate large transactions without significantly impacting the price. This becomes an important feature in the volatile crypto market.

Lending Pools and Yield Generation

Users contribute to Curve by depositing their stablecoins into liquidity pools. These pools not only serve as the backbone for trading on the platform but also allow depositors to earn passive income. The income comes from two main sources: trading fees collected from the transactions that occur within the pool and interest earned from lending out the assets in the pool to other DeFi protocols. This dual income stream enhances the attractiveness of Curve to liquidity providers.

CRV Token and Governance

The introduction of the CRV token added a governance layer to Curve, allowing token holders to participate in decision-making processes. Governance tokens like CRV are instrumental in decentralised protocols because they enable a community-led approach to managing and updating the platform. Holders can propose changes, vote on different aspects of the protocol’s operation, and influence the direction of Curve’s development. The distribution of CRV tokens is designed to reward users who contribute liquidity to the platform, aligning the interests of active participants with the long-term success of Curve.

StableSwap – Optimised for Stablecoins

Curve’s StableSwap algorithm is another cornerstone of its functionality. This algorithm is optimised for assets that are supposed to have equal value, like different stablecoins pegged to the same currency. The StableSwap formula allows for extremely efficient trades with minimal slippage, far surpassing the performance of traditional AMMs when dealing with similar assets. This efficiency is particularly important for users looking to swap large amounts of stablecoins, as it ensures they get the best possible rate with the least possible loss.

Risk Mitigation and Impermanent Loss

One of the challenges in liquidity provision is the risk of impermanent loss, which occurs when the price ratio of deposited assets changes compared to when they were deposited. However, because Curve focuses on stablecoins, which are less volatile than other cryptocurrencies, the risk of impermanent loss is significantly reduced. This stability is a key advantage for liquidity providers, making Curve an attractive platform for those looking to earn yield on their stablecoin holdings with reduced risk.

Advantages of using Curve

Curve’s StableSwap system is engineered to provide the best possible trading price, minimal losses, and low fees, making it an attractive option for stablecoin traders and liquidity providers seeking to minimise slippage. This efficiency in trading is complemented by the platform’s ability to offer higher long-term profit margins and reduce the risk of impermanent losses, a common challenge in other AMM projects like Uniswap or Compound.

Impermanent losses occur when the value of a liquidity provider’s deposit changes compared to when they withdraw it, often leading to financial setbacks. By facilitating direct exchanges between different types of tokens without the need for intermediary conversions, Curve offers a more cost-effective and straightforward trading experience.

In conclusion, Curve Finance provides a specialised platform for stablecoin trading that prioritises efficiency, low fees, and user rewards. Its innovative use of liquidity pools and governance structure, coupled with the leadership of Michael Egorov and his team, positions Curve as a leading solution for users looking to trade stablecoins with minimal slippage and optimised returns.