The news that $XRP is not a security has made the crypto space jump for joy today, leading to massive gains across the market.

Ripple’s XRP has now overtaken BNB coin as the fourth-largest crypto by market cap, and is currently trading at $0.79, up 67.15% in the past day.

Following in its happy wake, some of the market’s leading altcoins are living their best lives right now. These best-performers are:

Stellar (XLM) – currently enjoying a rise of more than 54.5% to trade at $0.1482.

Solana (SOL) – currently up 26% to trade at $28.08.

Synthetix (SNX) – up 22.42% to trade at $2.54.

The other coins in the top 10 with double-digit gains this morning include Cardano (ADA), Lido DAO (LDO), Pepe (PEPE), Avalanche (AVAX), ApeCoin (APE), Near Protocol (NEAR), and Optimism (OP).

Overall, the global crypto market is currently trading at $1.25trillion, a 4.94% increase in the last day. Meanwhile, Bitcoin is trading at $31,180.18, up 2.05%, with Ethereum at $1,994.66, up 6.02%.

The morning’s coins that are trading downwards include eCash (XEC), Bitcoin Cash (BCH), Compound (COMP), UNUS SED LEO (LEO), Bitcoin SV (BSV), and Stacks (STX).

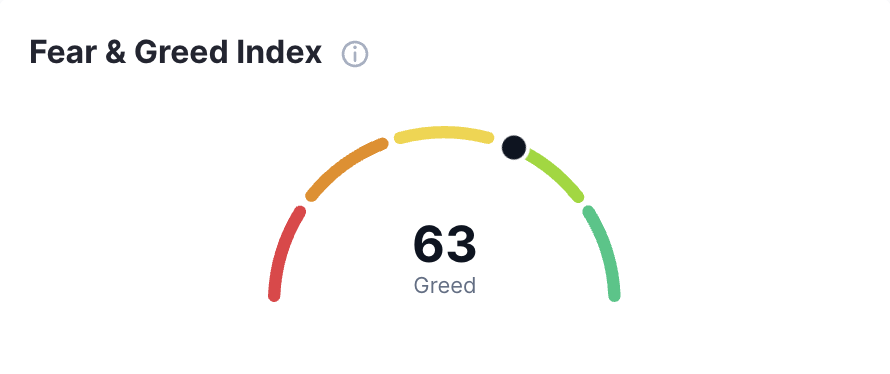

According to data from CoinMarketCap, the Fear and Greed index is showing 63 for ‘Greed’. When the marker is nearer to the 100 spot, the market is in ‘Extreme Greed’, indicating a likely correction.

XRP is not a security

Yesterday, after more than two years of a long-drawn lawsuit, the United States District Judge Analisa Torres ruled in favour of Ripple’s $XRP, saying that sales do not constitute an offer of investment contract.

The ruling has been welcomed as a major victory for Ripple in its case to prove that its native asset XRP does not satisfy all conditions of the Howey Test, used in the US to determine whether an asset is a security.

Ripple’s chief legal officer Stuart Alderoty has since tweeted: “A huge win today – as a matter of law – XRP is not a security. Also a matter of law – sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions – to developers, to charities, to employees are not securities.

“The only thing the Court found constitutes an investment contract is past direct XRP sales to institutional clients. There will be further court proceedings only on these institutional sales per the Court’s order.”

He added: “Maybe we can now start a rational conversation about crypto regulation in this country.”