The unyielding dominance of Bitcoin, despite analysts’ projections of a seismic shift fuelled by the DeFi boom, has been underscored once again in the latest Digital Asset Fund Flows Weekly Report.

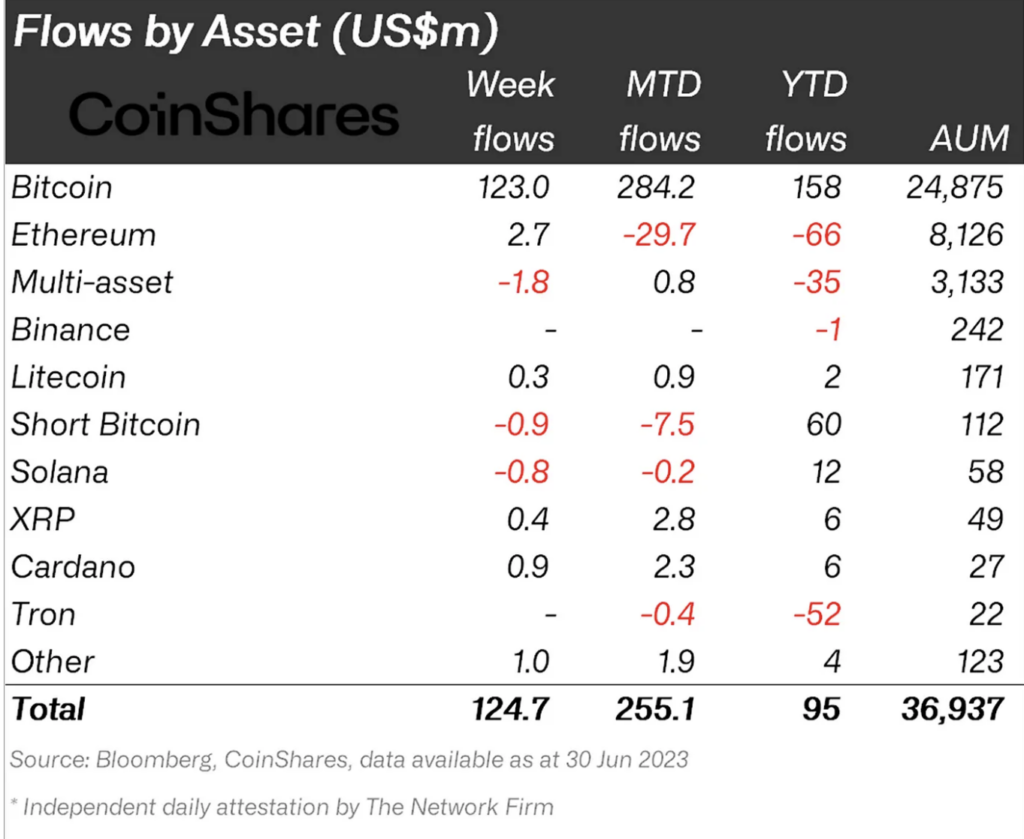

According to the report by European digital asset manager Coinshares, digital asset investments recorded inflow of $125million for the week, bringing the total inflows over the past two weeks to $334m.

Of this week’s inflow, Bitcoin accounts for $123m, capturing an impressive 98% share of the total digital assets inflow. The recent surge in inflow ends the trend of a net outflow, bringing Bitcoin investment products back to a net inflow year-to-date.

As investor confidence in Bitcoin grows and the crypto takes centre stage as their primary focus, bears are taking precautions against potential losses. This cautious approach is evident in the outflow of short-Bitcoin investment products, indicating a trend of investors hedging their positions to mitigate risks.

About $0.9m outflow was recorded this week for these products, marking a tenth consecutive week of outflows. The net withdrawal of funds from investment products that are specifically designed to profit from a decline in the price of Bitcoin reflects a prevailing sentiment that its price is expected to either remain stable or continue to rise in the near term.

There were modest inflows observed by altcoins, with Ethereum leading the pack with total inflows amounting to US$2.7m. Following closely were Cardano, Polygon, and XRP, also experiencing minor inflows. In terms of assets under management, Bitcoin constitutes 67% of total digital asset holdings by fund managers. Ethereum is second at 22%.

Bitcoin’s dominance continues

Bitcoin’s dominance reached new highs recently following renewed interest by institutional investors and fund managers who have filed for spot Bitcoin ETFs.

On 21 June, its dominance reached 51.3%, marking a two-year high. It has retained this dominance level and is around 51.26% at the time of writing.

Analysts predict that Bitcoin’s dominance may further increase as the race for the first spot Bitcoin ETF intensifies and an approval becomes more likely. In sharp contrast to this positive outlook for Bitcoin, altcoins have been facing challenges due to the SEC’s regulatory scrutiny.

The regulatory watchdog’s classification of prominent altcoins as securities has dealt a severe blow to their growth and acceptance in the market. Exchanges have responded with a wave of delistings, and investors have responded with massive sell-offs, further compounding their challenges.