Judge Lewis Kaplan is set to determine the length of former FTX CEO Sam Bankman-Fried’s (SBF) incarceration period on 28 March, marking a culmination of the high-profile case surrounding the collapse of the cryptocurrency exchange, FTX.

This follows a month-long trial, after which the New York jury found Bankman-Fried guilty on seven counts of fraud and conspiracy to commit fraud.

SBF was charged with wire fraud and conspiracy to commit wire fraud against FTX’s customers, wire fraud and conspiracy to commit wire fraud against Alameda’s lenders, conspiracy to commit securities fraud against FTX’s investors, conspiracy to commit commodities fraud against FTX’s customers and conspiracy to commit money laundering.

A plea for compassion

Amidst the legal proceedings, voices have emerged from Bankman-Fried’s past and present, seeking leniency for the convicted former CEO.

Advocates have directed their appeals to the Southern District of New York’s court, urging Judge Kaplan to consider Bankman-Fried’s personal circumstances and purported intentions.

Noteworthy among the pleas is that of Dr. Adam Hesterberg, who shared a home with Bankman-Fried from 2012 to 2014.

He spotlighted the defendant’s transition to a vegan lifestyle and his influence on others to adopt vegetarianism, suggesting these are indicative of his character.

Maria Centrella, although not personally acquainted with Bankman-Fried, brought attention to the complexities of autism.

She proposed that his cognitive differences may have clouded his understanding and intentions behind the actions that led to FTX’s collapse. As a mother of a child diagnosed with autism, she added:

“I can speak from experience that the minds of those on the spectrum work differently. Though I have never met Sam, I firmly believe that while he may be an MIT grad – he did not fully understand the scope of what was going on and did not have malicious intent.”

Judicial and public scrutiny

However, the prosecution has tabled a stern recommendation for Bankman-Fried’s sentencing, advocating for a prison term ranging from 40 to 50 years.

Their argument hinges on the sheer scale of the fraud perpetrated and its catastrophic impact on thousands of victims, underlining the need for a sentence that serves as both punishment and deterrent.

Conversely, the legal team representing Sam Bankman-Fried has proposed a considerably shorter sentence of 6.5 years in prison.

While the law permits Judge Kaplan the discretion to impose a sentence as lengthy as 110 years, prevailing opinions hint that such a severe punishment may not be the chosen course of action.

The narrative of leniency faces resistance not only from the legal system but also from the broader community.

Critics argue that Bankman-Fried’s personal challenges and dietary choices should not mitigate the severity of his crimes.

Lucas Gates from AutismBC has publicly refuted the notion that Bankman-Fried’s actions should be excused due to his autism, emphasising the deliberate nature of his fraud. In a 28 February X post, he had said:

“SBF does not deserve to get off lightly for his crimes because of the ‘autism defence. He knew what he did was fraud, and he should go to prison for the rest of his days.”

Beyond the legal battles and public debates, the true toll of FTX’s downfall is most poignantly expressed by those it directly affected.

Victims have shared harrowing accounts of their experiences, from losing life savings to facing uncertain financial futures, painting a human face on the fallout of Bankman-Fried’s actions.

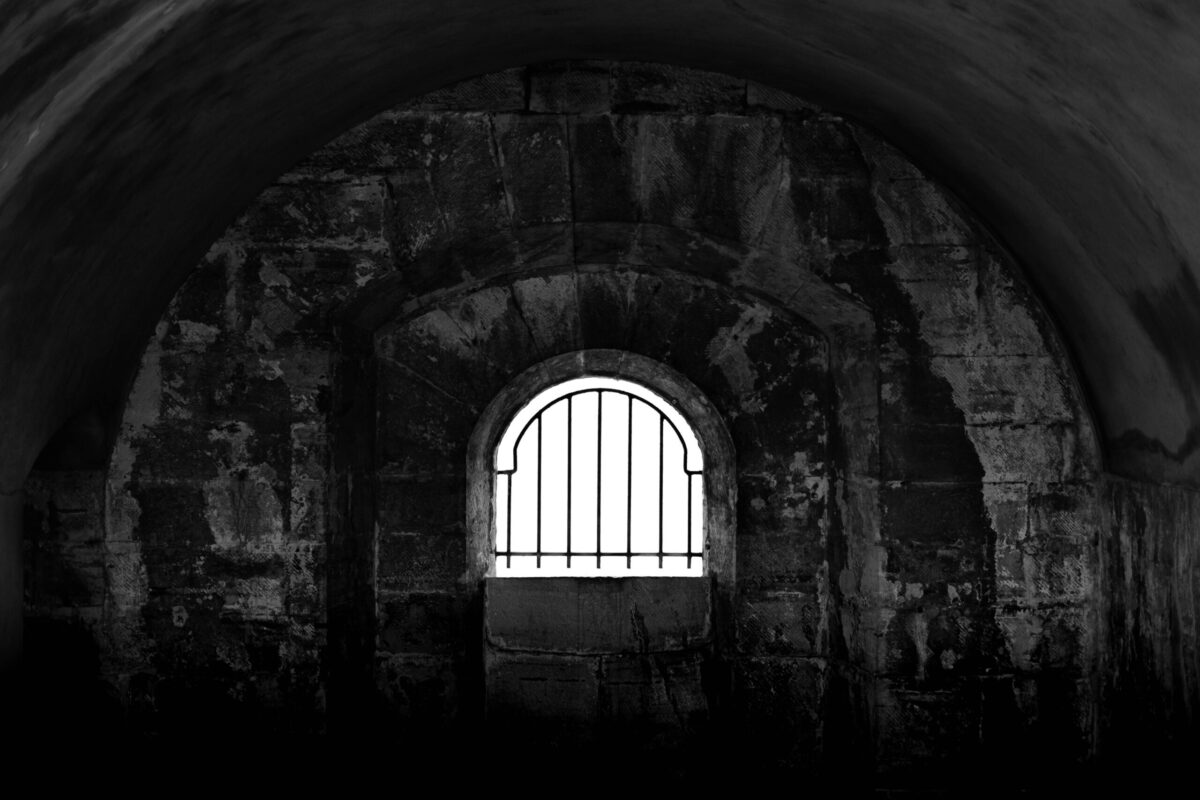

The former CEO has been in prison since Judge Kaplan revoked his bail in August 2023. This was after he allegedly attempted to influence or intimidate witnesses in his criminal case.