In a recent cybersecurity incident, Euler Finance, a blockchain-based lending platform, has fallen victim to a hack. The hackers successfully exploited a vulnerability in the system, stealing over $28 million worth of crypto assets. Interestingly, the exchange has entered into a dialogue with the hackers, leading to recent developments in the situation.

The Hack: How It Happened

Euler Finance fell victim to a sophisticated attack on its smart contract, which allowed the hackers to drain funds from the lending platform. The specifics of the hack include:

- Exploiting a vulnerability in the platform’s smart contract

- Siphoning off over $28 million in cryptocurrency assets

- Funds being drained from various pools, including stablecoins and Wrapped Ether (WETH)

The Hacker’s Exchange with Euler Finance

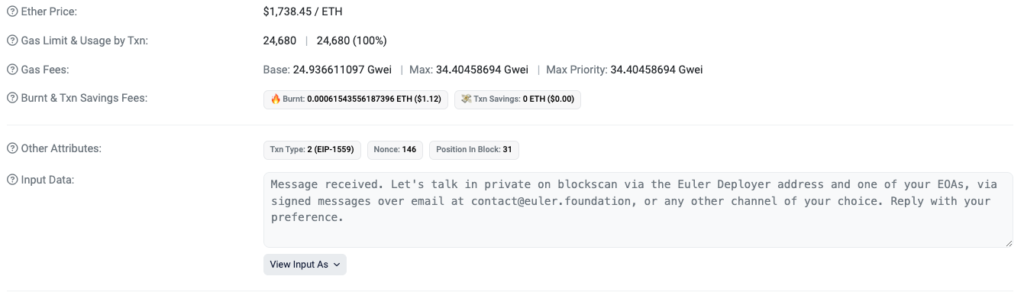

Following the attack, Euler Finance established communication with the hackers through the Ethereum Name Service (ENS). In a surprising turn of events, the hackers have been cooperative, providing valuable information on the vulnerability that they exploited.

- The hackers used an ENS domain to communicate with Euler Finance

- They revealed the details of the vulnerability they exploited

- Euler Finance expressed gratitude for the information provided

Recent Developments: A Potential Recovery

As a result of the ongoing dialogue with the hackers, Euler Finance has gained valuable insights into the vulnerability and the stolen funds. The platform is now working on a recovery plan to potentially retrieve the stolen assets.

- Euler Finance is developing a recovery plan to salvage the stolen funds

- The platform is considering a token migration to a new smart contract

- The recovery plan includes securing the platform from future attacks

Community Reaction and Market Impact

The cryptocurrency community has shown mixed reactions to the recent events. Some appreciate Euler Finance’s efforts to communicate with the hackers and gather information, while others criticize the platform’s security measures.

- The hack has caused uncertainty among investors and users

- Euler Finance’s token (EULER) price experienced a sharp decline following the hack

- The platform is working to regain the trust of the community and investors

Lessons Learned and Future Implications

This incident highlights the importance of robust security measures in the cryptocurrency space. As more financial services become decentralized, it is crucial for platforms to prioritize security and continuously audit their systems.

- Crypto platforms must prioritize security and perform regular audits

- The need for collaboration between platforms and security researchers to identify vulnerabilities

- The incident serves as a reminder of the risks associated with decentralized finance (DeFi)

The Euler Finance hack demonstrates the ever-present threat of cyberattacks in the world of cryptocurrency. The platform’s proactive approach in communicating with the hackers, and the subsequent developments, may offer a glimmer of hope for the recovery of stolen assets. However, this incident serves as a stark reminder of the importance of stringent security measures and continuous audits for DeFi platforms.