Major cryptocurrency tokens saw a sharp decline during Asia trading hours on Tuesday.

This seemed to be driven by continued profit-taking and another day of net outflows from US-listed Bitcoin exchange-traded funds (ETFs). The movement has resulted in a dampened bullish sentiment in the market.

Bitcoin ($BTC) experienced new one-month lows on 18 June, failing to maintain its momentum past $67,000.

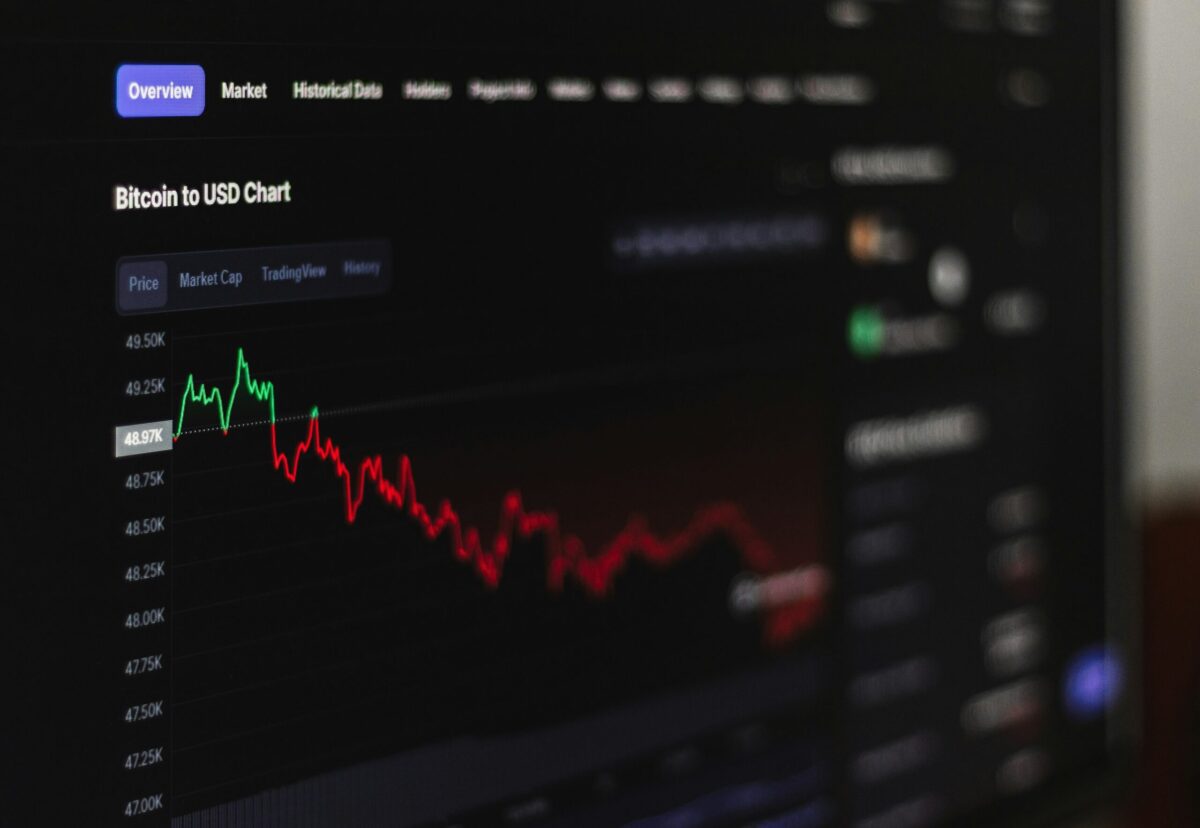

Data from TradingView captured the volatile price conditions, which included a brief peak at $67,250 before sellers pushed it down to $64,050, the lowest since 15 May.

Meanwhile, Bitcoin ETFs recorded net outflows of $145 million, continuing the previous week’s downward trend.

Second largest cryptocurrency, Ethereum ($ETH) also faced a decline, dropping to $3,400 and erasing all of last week’s gains. At the time of press, it was down by over 3% daily, struggling in the red on its charts.

Neil Roarty, an analyst at Stocklytics, commented on the situation, stating, “A strong dollar tends to put downward pressure on Bitcoin”, adding that significantly lower interest rates and a weaker dollar would be necessary to push $BTC closer to the $70,000 mark.

FxPro senior market analyst, Alex Kuptsikevich, also echoed a bearish sentiment, noting that recent positive developments for Ether ETFs did not support $ETH prices as expected.

He warned that the increased liquidity during weekdays could favour bears, leading to more selling interest in the market.

Altcoin performance

The cryptocurrency market’s downturn extended to altcoins, with many experiencing significant losses. Dogecoin ($DOGE) and Solana ($SOL) were among the hardest hit, each dropping around 9% over the past 24 hours.

This decline followed Bitcoin’s plunge below $65,000 and Ethereum’s drop under the $3,500 resistance level.

The increasing dominance of Bitcoin during its correction has led to even steeper declines in altcoins. Shiba Inu ($SHIB) and Uniswap ($UNI) for example, have each fallen by around 10%.

Cardano ($ADA), Avalanche ($AVAX), and Chainlink ($LINK) are experiencing significant losses, with Polkadot ($DOT) dropping below $6.

$XRP stands out as the exception among large-cap altcoins. Ripple’s native token has risen to just over $0.50, bucking the trend in an otherwise declining market.

Ton Network’s $TON dropped 5%, while BNB Chain’s $BNB showed relative resilience with a 1.5% loss.

The broad-based CoinDesk 20 (CD20) index, which includes the largest tokens minus stablecoins, was down 4.2%.

The overall market sentiment remained cautious at the time of writing, with many investors reacting to the volatile conditions and ongoing profit-taking.

The broader cryptocurrency market was down by over 2%, dumping to under $2.5 trillion within the past day. This resulted in a loss of roughly $100 billion since yesterday’s peak.

Meme coins take a hit

Meme coins also suffered in the recent market downturn, with popular tokens like Dogewifhat ($WIF), Pepe ($PEPE), and Floki Inu ($FLOKI) experiencing steeper declines.

Two of the most controversial meme coins, $MOTHER and $DADDY, were among the worst performers.

$MOTHER, a token announced by Australian model and rapper Iggy Azalea, has fallen over 40%, with its market capitalisation slipping below $80 million.

$DADDY, promoted by online influencer Andrew Tate, dropped 22% in a day, now trading at around $0.14, a significant decline from its peak of $0.35 earlier this month.

Despite initial gains, $MOTHER faced criticism, notably from Ethereum co-founder Vitalik Buterin, who expressed dissatisfaction with the current celebrity-driven meme coin trend.

Andrew Tate, known for his controversial views, supported $DADDY, aiming to surpass $MOTHER in value. Crypto analytics firm Bubblemaps revealed that Tate received 40% of all $DADDY tokens, valued at around $33 million, and promised to burn his share to create “chaos” rather than profit.

The significant losses in the meme coin sector highlight the volatility and speculative nature of these tokens, with recent events adding to the broader market’s challenges.