The Bitcoin price is trading at $105,425 after a 4% jump on a 5% surge in trading volume to $65 billion.

Bitcoin price bounced back after falling below $100,000, a drop caused by rising tensions between the U.S. and Iran.

The price hit a low of around $98,974 after reports of U.S. military strikes but has since recovered to about $105,100. That’s a 5% gain in the last 24 hours, though Bitcoin is still down nearly 6% over the past week.

Bitcoin Holders Stay Calm as Market Pauses

Despite the recent price swings, experts say the market is showing signs of consolidation, not collapse. CryptoQuant analyst Darkfost explained that long-term Bitcoin holders are staying put, which shows they still believe in the market.

His analysis of an on-chain indicator called Coin Days Destroyed (CDD) shows the market isn’t overheating, and this quiet period could set the stage for another price surge, like we’ve seen in past bull markets.

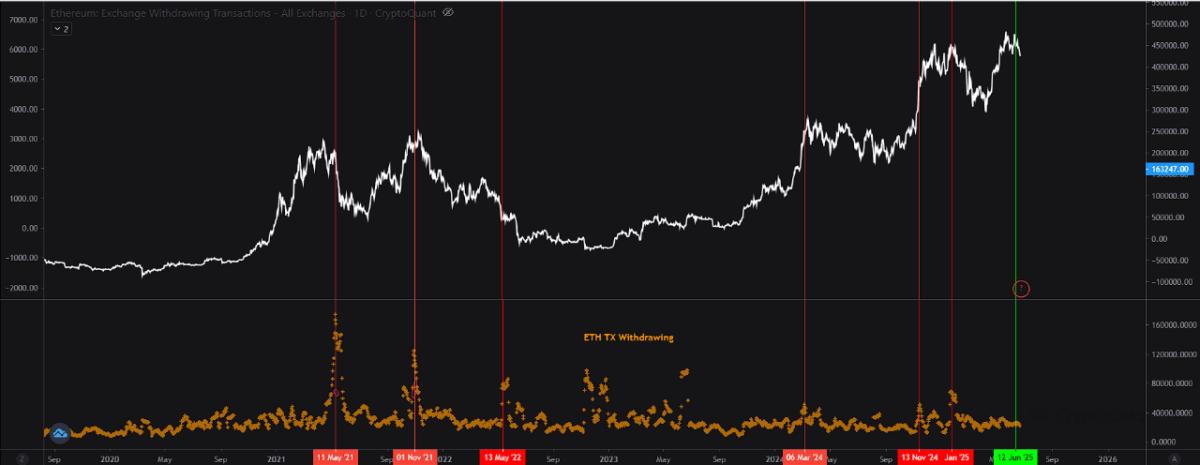

Another CryptoQuant expert, Mignolet, looked at whale activity, the behavior of large investors. He said there are no signs of whales rushing to sell, which is different from what happened before the 2021 market top. Ethereum outflows, often used to track big investors leaving the market, also remain calm.

Bitcoin Price Signals Bearish Reversal After Double Top Formation

The BTCUSDT daily chart shows Bitcoin losing momentum after failing to hold above the $110,000 level. The chart highlights a clear double-top pattern, a classic bearish signal that often suggests a potential trend reversal.

The RSI (Relative Strength Index) is currently around 51.70, showing neutral momentum but tilting lower. This means buyers are losing strength, and there’s room for more downside if the selling pressure increases.

Before this, Bitcoin price had been trading inside a strong bullish channel, with prices climbing steadily from below $85,000 to above $110,000. However, after forming the double top, the price entered a period of consolidation, where it moved sideways without clear direction.

That consolidation has now broken to the downside, signaling a possible bearish reversal. If sellers continue to dominate, Bitcoin could head lower towards the major support zone between $85,000 and $90,000. This zone will be critical for the bulls to defend. A break below it may lead to further losses.

BTC Price Hovers Near Key Support

Despite these bearish signs, the long-term trend is still intact as long as Bitcoin holds above the major support zone. A bounce from this area could signal the start of a new upward move, while failure to hold could lead to deeper corrections.

For now, traders should watch key levels at $100,000 psychological mark, the $85,000 support zone, and the $110,000 resistance. A break above $110,000 would cancel the bearish setup, but if support fails, expect more downside.